- Several

analysts expect blockchain will first prove its value in supply chain

management, where Cisco and IBM are both working on applying the technology.

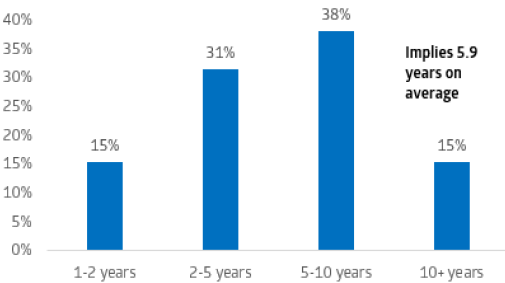

- Still, industry experts project on average that the technology will take 5.9 years to gain widespread adoption, according to a Cowen survey.

- Many blockchain enthusiasts also say the technology will work best not as a new system within private enterprise, but in its pure form — an open-source, publicly accessible platform powered by a global network of users.

When it comes to proving the tangible benefits of the blockchain technology that many expect to change the world, it is still very early days and the earliest viable applications will likely be in supply chain management, rather than financial services, executives say.

In fact, Cisco stopped researching blockchain applications in financial services after 18 months because it will take a while for the many players in the complex markets to get up to speed, Anoop Nannra, head of the company's blockchain initiative, told CNBC in May. Instead, for the last year or so he said the team has been investigating blockchain applications in supply chain management.

Even still, their research indicates it will be roughly 10 years before blockchain really becomes prevalent in supply chain management. For financial services, Nannra predicts somewhere from five to 25 years.

"It's anyone's guess," Nannra said. "When you're trying to drive a mindset shift it's almost a generational thing."

Expected years for widespread adoption of blockchain

Source: Altman Vilandrie; Cowen and Company.

Companies and governments across industries are exploring blockchain. Market intelligence firm IDC predicts global spending on blockchain solutions will more than double to $2.1 billion this year, according to a Cowen report on May 24. However, Cowen also said a survey of 23 executives and experts in the field expect on average the technology will take 5.9 years to gain widespread adoption.

In theory, blockchain — often referred to as distributed-ledger technology by corporations — cuts costs and increases transaction efficiency because the technology eliminates the need for a third-party intermediary, such as a bank. Bitcoin is the first application of blockchain technology, with a focus on payments. Its price, and that of many other cryptocurrencies, skyrocketed last year as investors speculated on the potential for blockchain to change the world as much as the internet did.

But by late last year it was becoming apparent to many that blockchain technology isn't necessarily the best solution in many cases. It could add complexity to existing systems.

Mark Smith, CEO of blockchain development company Symbiont, said that after four years of research, the firm has found the technology works best when there's an opportunity to automate processes, such as data collection.

"I think supply chain is going to be the first, if not near the first, to really show the value of blockchain," Smith said. "There aren't any regulatory questions in supply chain management that you have to deal with."

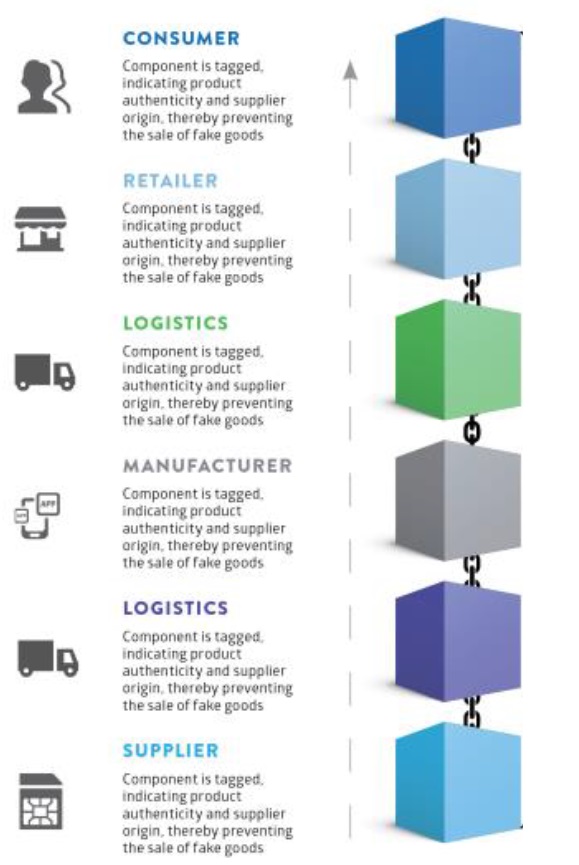

Anatomy of a supply chain

Source: Cowen

IBM, the most outspoken corporation on blockchain, has announced major projects in applying the technology to global supply chains:

"Big Blue" partnered with UBS in 2016 to improve trade financing by using blockchain to verify transactions and automatically release payments as a shipment travels from a warehouse to an airplane, truck or boat and arrives at a port. Bank of Montreal, CaixaBank, Commerzbank and Erste have since joined the project, called Batavia.

In August 2017, IBM announced Walmart, Tyson Foods, grocery supply chain company McLane, Driscoll's and other major companies in the global food supply chain formed a consortium to develop a blockchain application for the industry.

In January, Maersk and IBM announced plans to form a joint venture to improve efficiency in global trade by using blockchain technology to standardize data collection. IBM is in a quiet period about the venture and could not speak directly about it.

"Blockchain's really about trust in data and business processes," said Ramesh Gopinath, vice president of blockchain solutions at IBM. "When you have to rely on data, four or five hops upstream, you have to have a reason to trust it and blockchain provides that."

He said four key elements for a viable blockchain-based platform are: members, data, applications and the application programming interface for third parties.

If trust is blockchain's real value, many enthusiasts say the technology will work best not as a new system within private enterprise, but in its pure form — an open-source, publicly accessible platform powered by a global network of users.

In supply chain management, start-up Eximchain is looking to launch the first public platform for the industry using blockchain. The company plans to keep user transactions encrypted using Quorum, an open-source blockchain program spearheaded by J.P. Morgan.

Hope Liu, formerly of UBS, co-launched Eximchain through MIT in 2015 and has raised $20 million for the company. Her immediate goal is to give millions of small and medium-sized enterprises a jump-start at gaining enough credibility through blockchain records to get better financing.

Suppliers have the earliest upfront costs, but typically get paid last. Having a record of their contribution to a finished product on a blockchain could help suppliers get loans to fund new orders before getting paid for prior work.

"The longer the supply chain … the more parts, the more value," Liu said. "We actually turned down some of the customers because their use case doesn't make sense [for blockchain]."

In finance, some companies have found they didn't need blockchain either.

"The return on investment for large-scale DLT solutions in highly efficient, deep and mature markets does not exist today," Michael Bodson, CEO of clearing and settlement giant DTCC, said in the company's 2017 annual report.

"New technology isn't always needed to drive innovation. As we demonstrated last September, the move to a T+2 settlement cycle in the U.S. was achieved using current technology," Bodson said. DTCC began exploring blockchain more than two years ago.

But financial institutions aren't about to abandon their research in blockchain. DTCC is planning to test the technology for managing credit derivatives records. Citi and Goldman Sachs rank among the five corporations exploring and investing the most in blockchain in the six years through the first quarter of 2018, according to CB Insights.

Blockchain represents "a big change, honestly, in the financial system," said William D'Angelo, partner at law firm Drinker Biddle in Los Angeles. "The people that are most worried are the banks. They're spending millions and millions of dollars to build private blockchains so they don't feel like they're shut out."

In the meantime, far younger blockchain companies are looking for areas in finance in which the technology does make sense. Some start-ups are using the technology for cross-border payments. Five-year-old Symbiont is working with Vanguard to process some index data, and developing a blockchain platform for investment in private equity funds.

Many of the blockchain projects have also decided to circumvent traditional funding routes by directly issuing digital tokens through initial coin offerings. The ICOs have raised $9.1 billion so far this year, according to financial research firm Autonomous Next.

But it remains to be seen whether start-ups or major corporations will be the first to unlock the full value of blockchain.

"We haven't disrupted a single industry yet with blockchain technology yet, but the industries we are disrupting are going to respond," said Robert Viglione, co-founder of ZenCash, a cryptocurrency focused on user privacy.

Previous page

Previous page Back to top

Back to top